高度な取引ツール

Unlock the potential of advanced trading tools on one of the best online trading platforms.

ワンクリックトレーディング

You can trade directly on a chart in predefined volume with one click to ride a move in a split of a second.

Trading On Chart

You can open, modify and close positions quickly, as well as manage pending orders.

トレーリングストップ

Lock your profit as your trailing stop adjusts your Stop Loss automatically as market moves in your favor.

トレーディングロボット

Straight from the platform, you can build and test trading robots in visual mode under real market conditions.

シグナル取引

You can choose professional traders’ signals and copy their trades in real time using your trading platform.

Hedge trade

Hedge trade to hedge your risk

You can buy and sell a same asset in opposite directions to be risk neutral on market volatility.

For example, A trader opens a position to buy 1 million barrels of Crude Oil, but due to a short-term political turbulence, the price of Crude Oil become unpredictable. In this case, the trade can place a hedged trade by selling another million barrels of Crude Oil to be market neutral without taking any margin call risk.

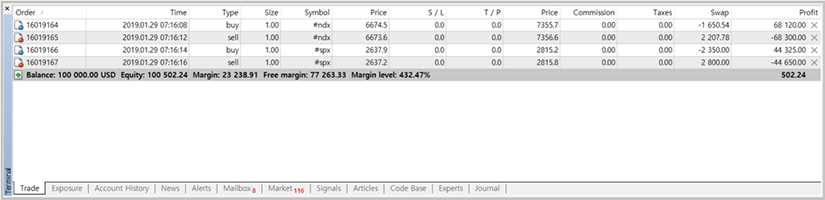

From the image above, you will see a trader hedged US stock index. The trader bought and sold the same amount of Nasdaq index and S&P 500 index. As a result, the trader achieves risk neutral market exposure while gaining overnight swap interest, profiting over $500 for holding position over two months.

ワンクリックトレーディング

Ride a move in a split of a second

Enable One Click Trading from a chart in your trading platform to place an order instantly with one click with predefined volume. It is fast but also dangerous because your order will be executed without asking you for any confirmation. This also enables you to open, modify and close positions quickly, as well as manage pending orders directly from a chart window.

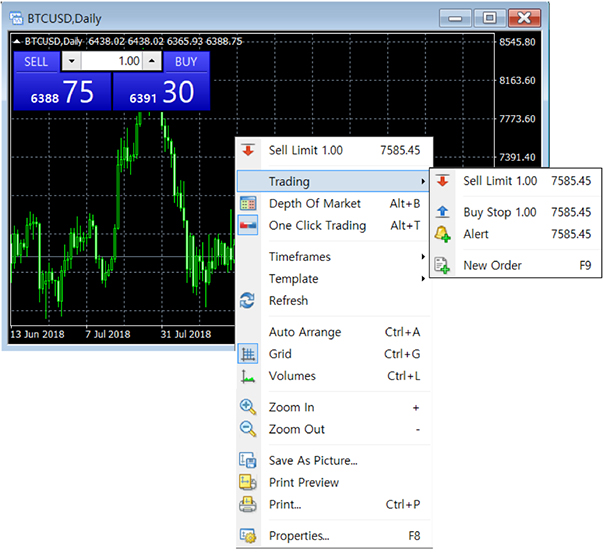

To perform One Click Trading operations directly on a chart, a special panel is available. To activate it, execute the “One Click Trading” command in the chart context menu using a right click.

チャート取引

Perform trading operations right on a chart

Combined with one click trading function, this enables users to open, modify and close positions quickly, as well as manage pending orders.

Placing Pending Orders

Pending orders can be placed from a chart using the Trading submenu of the chart’s context menu.

- Place your mouse cursor on the necessary price level on a chart and execute the appropriate command to install a pending order.

- According to the cursor’s position, available order types are displayed in the menu. If the menu is activated above the current price, the user can place Sell Limit and Buy Stop orders. If the menu is activated below the current price, Buy Limit and Sell Stop orders can be placed.

After executing the command, Order window will appear allowing users to adjust its parameters more precisely.

Managing price levels for Stop Loss, Take Profit, and Pending order

First, enable “Show trade levels” option in the terminal to see price levels. Then, simply click the price level you want to adjust and drag it to a price you want to change it to. Drop the price level by releasing the mouse button once the cursor is at the required price. When moving a level, there is a tooltip displaying potential profit (or loss) and pips that can be obtained if the level triggers.

After setting the level, the position modification window will appear, allowing users to adjust the level more precisely.

Trailing stop

Lock your profit with Trailing Stop

Trailing stop trails a market move in your favor by adjusting Stop Loss order automatically to increase your profit as long as the market moves in your favor. When the market changes its momentum and moves against your favor, Trailing Stop will no longer adjust your Stop Loss and your open position will be closed at the highest Stop Loss level that your Trailing Stop placed.

Trailing Stop is attached to an open position and works in your trading platform, only not in the server like Stop Loss, meaning if you turn off your trading platform, Trailing Stop will no longer adjust Stop Loss.

Trading Robot

Put your trading strategies into your trading robot and let your trading robots analyze the market and trade for you

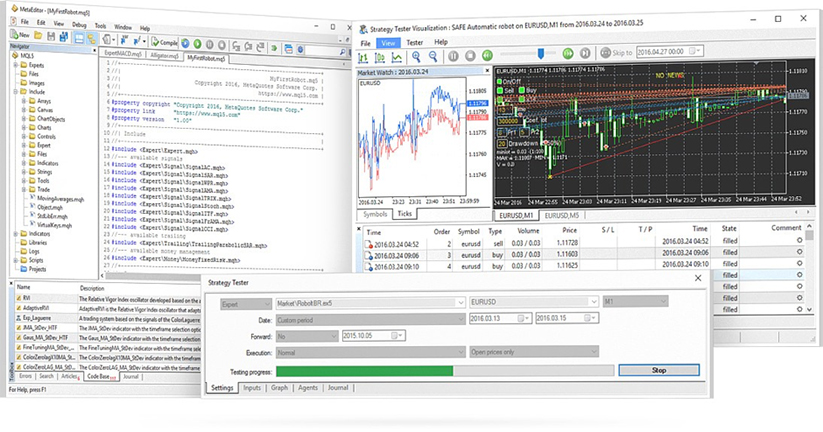

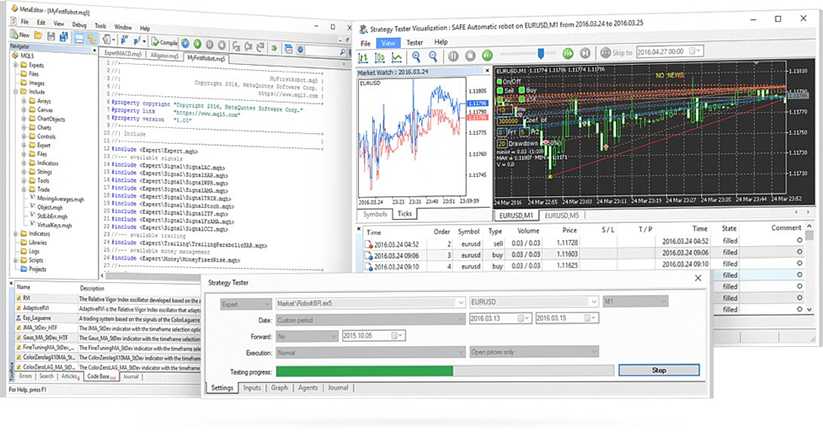

One of the most fascinating possibilities provided by MetaTrader is the trading robot feature, which enables automated trading using robots. These applications can analyze the market and perform trading operations in accordance with a specific trading strategy.

プログラミングの経験がない?

内蔵のウィザードを使用して、既製のブロックを使用して取引ロボットを組み立てます。

For experienced developers

C++ベースの高レベル・オブジェクト指向プログラミング言語が自由に利用できる。

Test your trading robot.Test and optimize a trading robot before real trading

実際の市場価格を使用したリスクフリーのデモ口座を使用してEA取引ロボットをテストしたり、内蔵のストラテジーテスターを使用して、取引プラットフォームから直接ヒストリカルデータを使用して取引ロボットの効率を評価することができます。

Strategy Testerは、選択した期間のヒストリカルデータを分析し、そのアルゴリズムに従って仮想操作を実行します。ストラテジー・テスターは、異なる資産を分析し、それらの資産間の相関関係を特定することができるマルチ資産取引ロボットをテストすることもできます。

The testing process can also be visualized as all trades performed by Strategy Tester are displayed on a chart.

A comprehensive testing report is also generated after a test run, allowing the detection of weak points in an Expert Advisor and making appropriate changes.

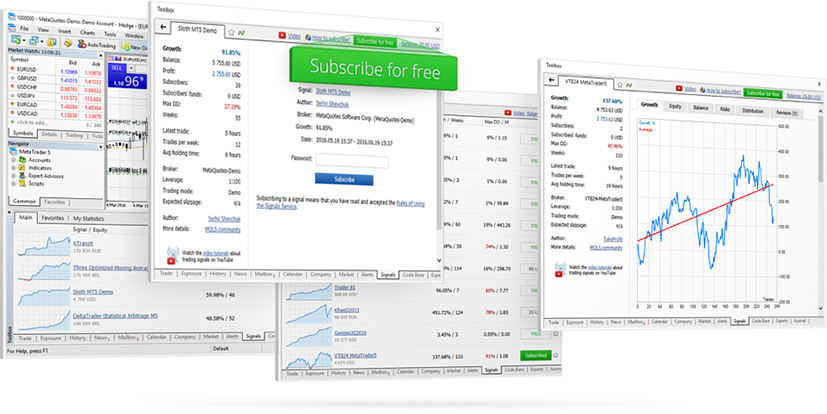

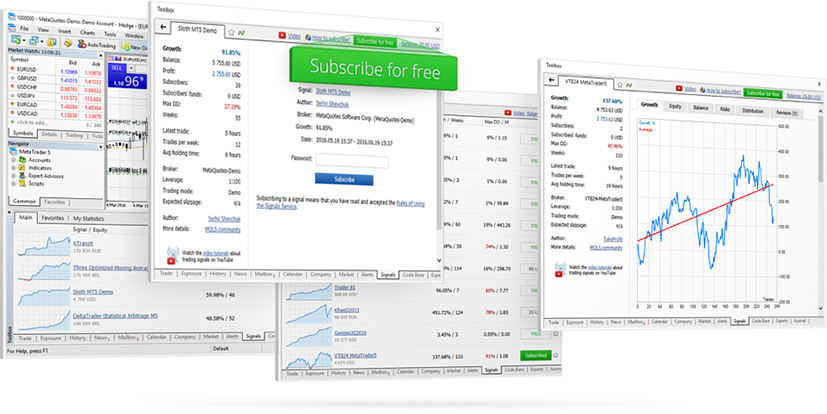

取引シグナル

Copy trades of others

Using Trading Signals services, your trading platform will copy trades from another account in real time.

How it works

Traders provide public access to their trades while others can subscribe to this signal for automatic execution on subscribers’ trading accounts.

Earn extra income

The Trading Signals service enables successful traders to earn extra income on a regular basis by selling signal subscriptions to thousands of users around the world.

Professional

テクニカル分析

Need tools to predict future market movements?

MetaTrader equips traders with the full arsenal of analytical tools for the most thorough price analysis and forecasting.

- 80 built-in technical indicators and analytical objects.

- 100のチャートを開き、必要なすべての金融商品を監視可能

- 21の時間枠で短期的な価格変動と長期的なトレンドを検証

With the all the exceptional technical analysis tools available in MetaTrader, you can be prepared for any market change!